Invoice Financing

Your Business Facing Tight Cash Flow?

- • Waiting 30-120 days for payment

- • Supplier payment pressure

- • Limited working capital

- • Missed growth opportunities due to cash constraints

To qualify, your business must:

- • Companies operating for a minimum of 1 year

- • Generating at least RM1 million revenue annually

- • With a minimum of 30% Malaysian ownership

- • Eligible entities include Sole Proprietorships, Partnerships, LLPs, Private Limited Companies, Unlisted Public Companies, Public Listed Companies & subsidiaries (excluding listed-company subsidiaries)

How We Can Help SME Grow Faster

Solutions designed to accelerate your business growth

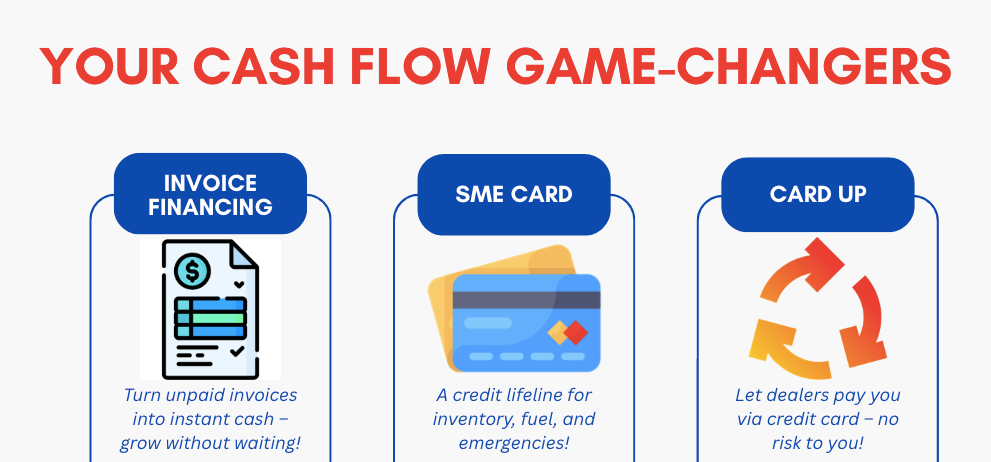

1. Invoice Financing

2. SME Corporate Card

3. CardUp / Payment Extension

Invoice Financing

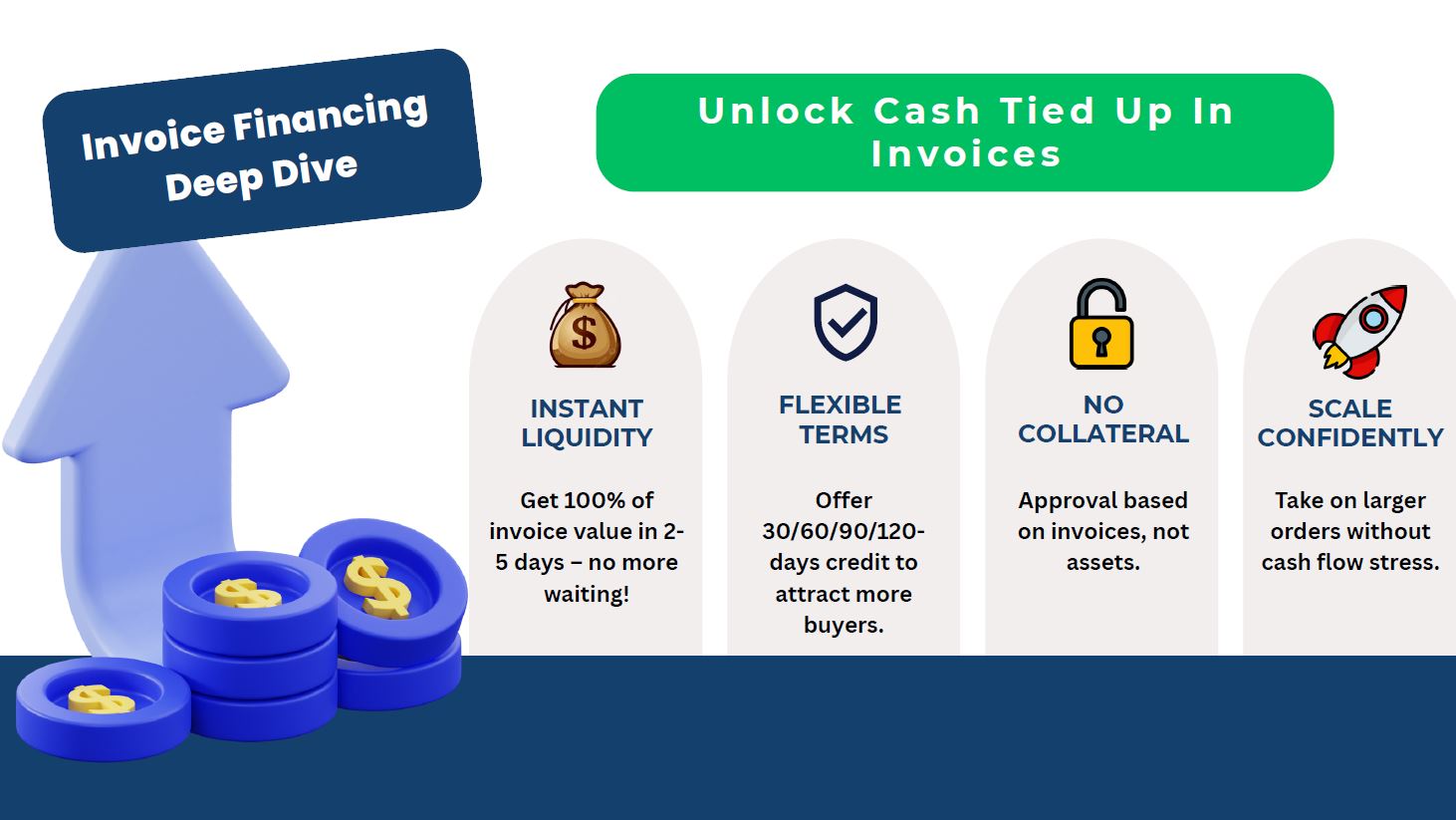

Why Choose Our Invoice Financing?

💰 Fast Cash Flow

Access 80–100% of your invoice value within 48 hours, giving your business immediate liquidity.

⚙️ Flexible Financing

No collateral required — finance your invoices easily and flexibly to suit your business needs.

🕒 Quick Approval

Apply online with a simple, fast approval process and get funded without delays.

🧾 Transparent Fees

No hidden costs — know exactly what you pay upfront, keeping your budgeting stress-free.

🧍♂️ For SMEs & Enterprises

Tailored solutions for small, medium, and large businesses to help you manage cash flow efficiently.

How an SME Corporate Card Helps Manage Company Finances

🌟 Key Advantages of Our SME Corporate Card

Extra Credit Limit

Access higher business-focused limits for bigger expenses and seasonal cash flow needs.

Covers Operational Expenses

Pay for fuel, utilities, office supplies, subscriptions, travel, and more — no personal cash required.

Build Company Credit History

Strengthen your business credit profile with every responsible transaction.

Exclusive Co-Branded Perks

Customise partner privileges tailored to business spending.

Better Visibility. Better Control. Better Growth.

Take charge of your business spending with a smarter financial tool designed for SMEs.

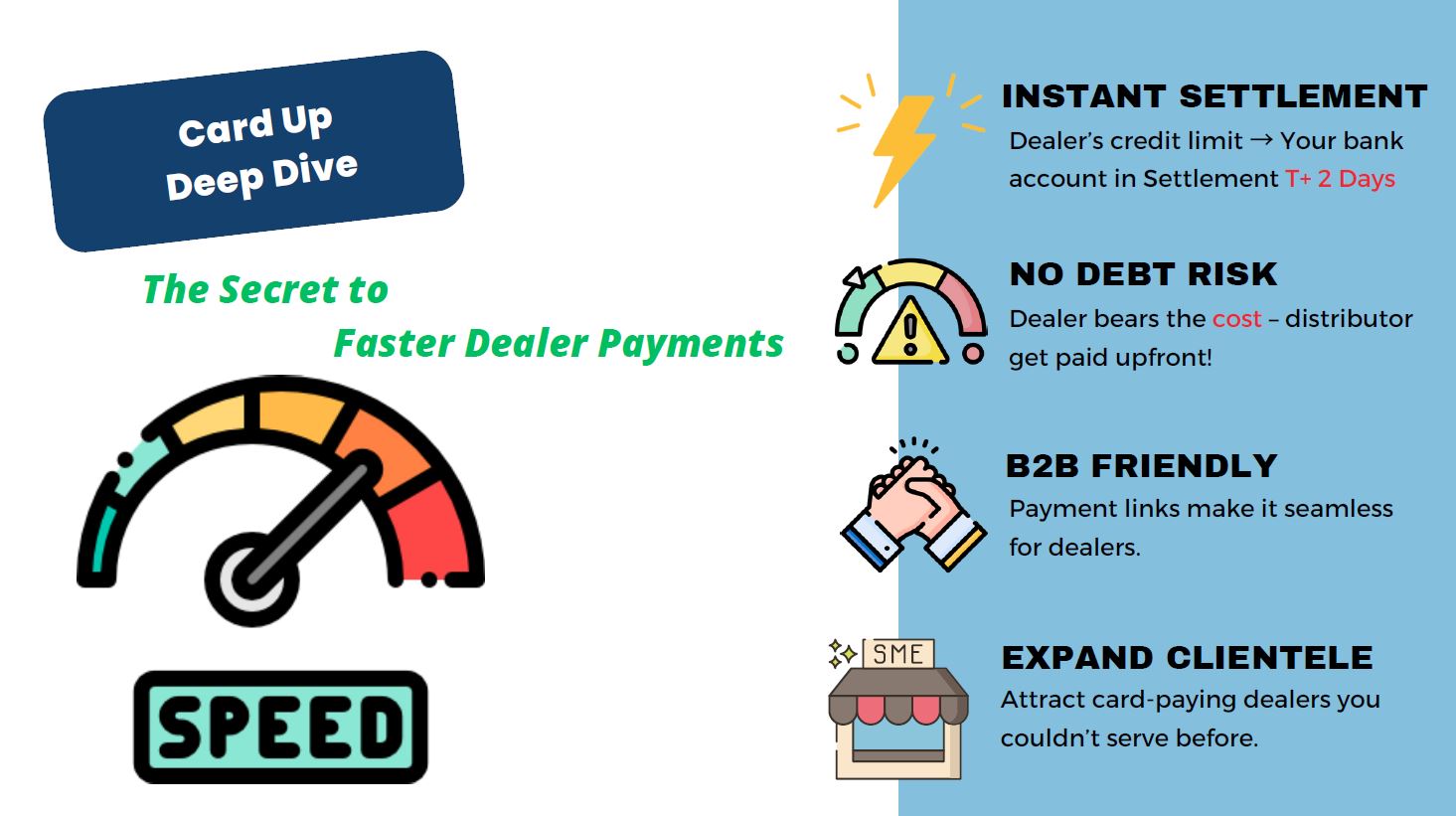

Instant Settlement

Convert collected payments from customer card into cash via platform

No more waiting weeks for transfers — enjoy faster revenue turnover and stronger liquidity.

No Debt Risk

You receive payments upfront without taking on loans or borrowing.

There is no long-term repayment obligation, and no impact on your company’s debt ratio.

Built for B2B Transactions

Accept payments easily from business clients through online payment channel.

Make it simpler for corporate customers to pay you, even for large value transactions.

Expand Your Clientele

Offer more flexible payment options to attract new customers.

Accept payments from clients who prefer card-based transactions, increasing your market reach and conversion rate.

SOCIAL PROOF – Testimonials – What our customer said

- 1

"After unlocking invoice financing, we grew 62% in 12 months. Cashflow stopped slowing us down — we could finally stock up ahead of demand."

- 2

"We used invoice financing consulting by VirtuaFin to secure longer supplier terms — up to 120 days. This helped us outpace competitors who could only offer COD."

- 3

"With the SME corporate card, we centralized all staff spending and improved budgeting. Our cost leakage dropped dramatically."

- 4

"Before, we were waiting 45–90 days for customers to pay. Now cash comes in immediately, so we close bigger orders confidently."

- 5

"We increased purchase volume by 70%, avoided stock shortages and expanded into 3 new regions. The financing support changed everything."

Frequently asked questions

Invoice Financing/-i is a broad concept of financing arrangement where it allows companies to finance their early payment on their sales invoices or sales purchases, for goods delivered and/or services completed. This method of financing is ideal for businesses in need of consistent cash flow or cash upfront, especially if the majority of their transactions are on credit terms.

With Invoice Financing, you can apply for a financing tenure of up to 120 days. Depending on the nature of your business and its trade cycle, you have the option to apply for a tenure of 30, 60, 90, or 120 days.

If this is your first time with us, here is a run-through on the application process. 1. Complete the application form. 2. Prepare the following documents to support your application: • Company Registration Forms • Copy of all Director(s) NRIC/Passport • Latest 6-months Bank Statement • Latest Audited Accounts & Management Accounts (if available) We will reach out to you shortly after your application. Should there be a need for additional documents/information, we will request those accordingly.

If you are late in making your repayments, the following fees/charges will be imposed: • Late Penalty Fee: RM 250 per 7 calendar day • Late Interest Fee: Up to 0.1% per day (non-compounded) on the amount in arrears

Of course! If you choose to settle the financing early, there are NO fees or charges imposed!

Any businesses whose principal activities are Shariah compliant (e.g. not related to tobacco, liquor, gambling etc.) can apply for the financing. Principle will be conducting Shariah screening to ensure proceeds to be raised are utilised for general working capital requirements and business purposes of the issuer which are Shariah compliant.